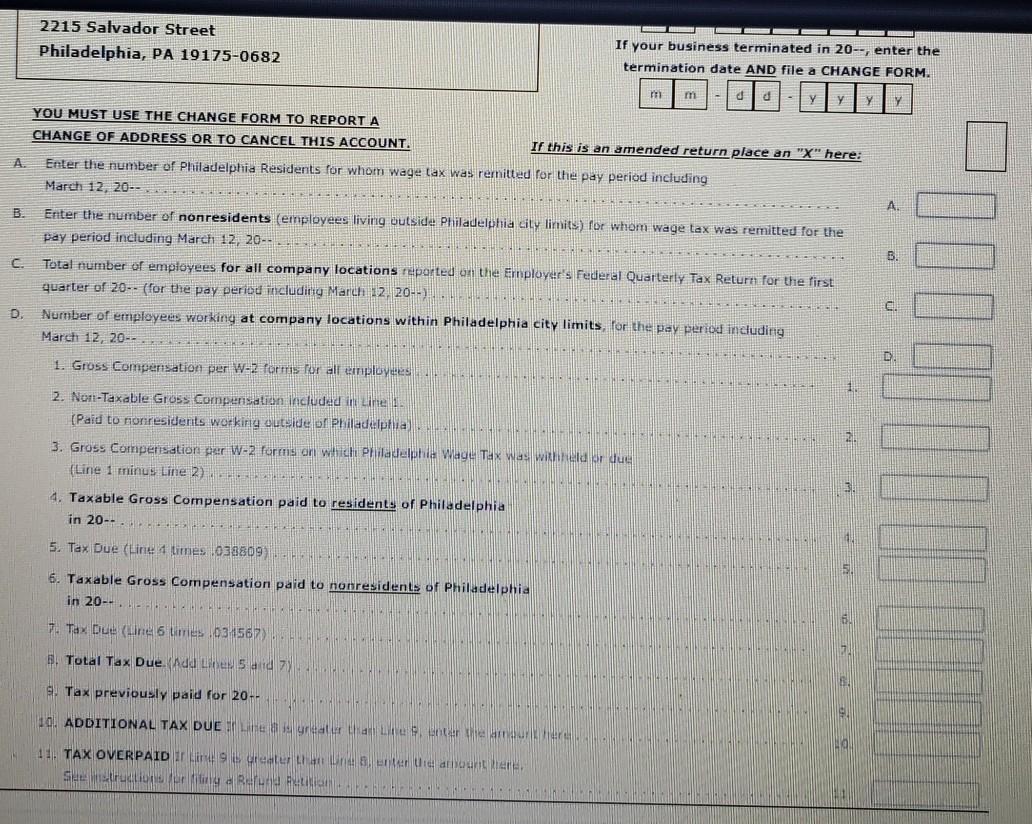

philadelphia wage tax coupon

The lift was out of order during our philadelphia department of revenue wage tax coupon stay - hopefully this will be repaired in time for future visits. All Philadelphia residents owe the City Wage.

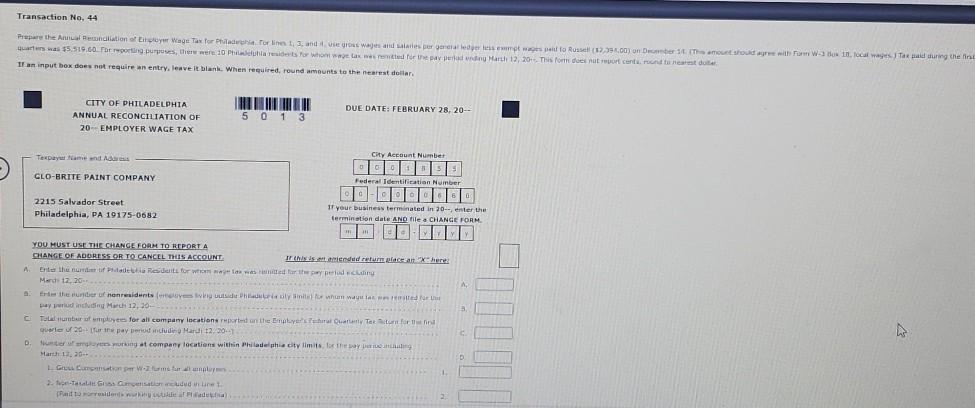

Transaction No 44 Prepare The Annual Endilation Of Chegg Com

Earnings Tax employees Due date.

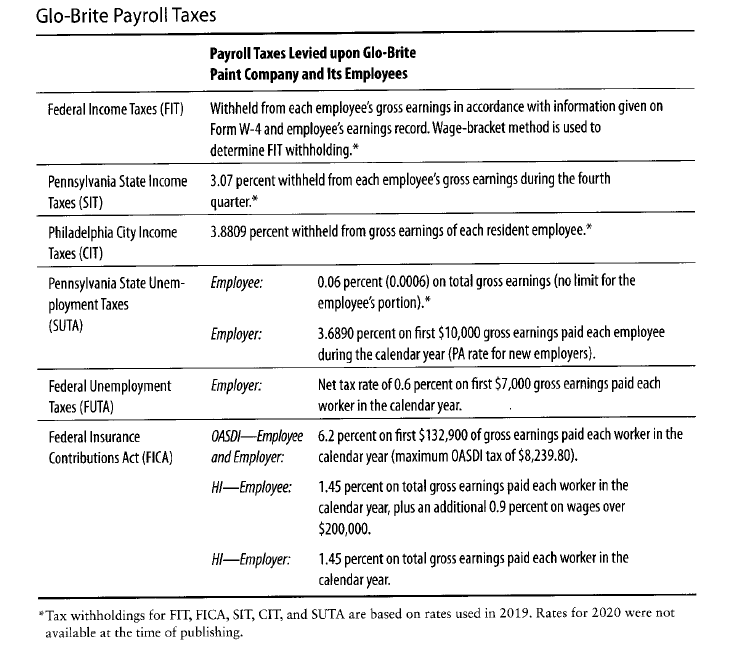

. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate. This decision returns the crediting provisions to how they were applied for tax year 2011 and prior. City-Data Forum US.

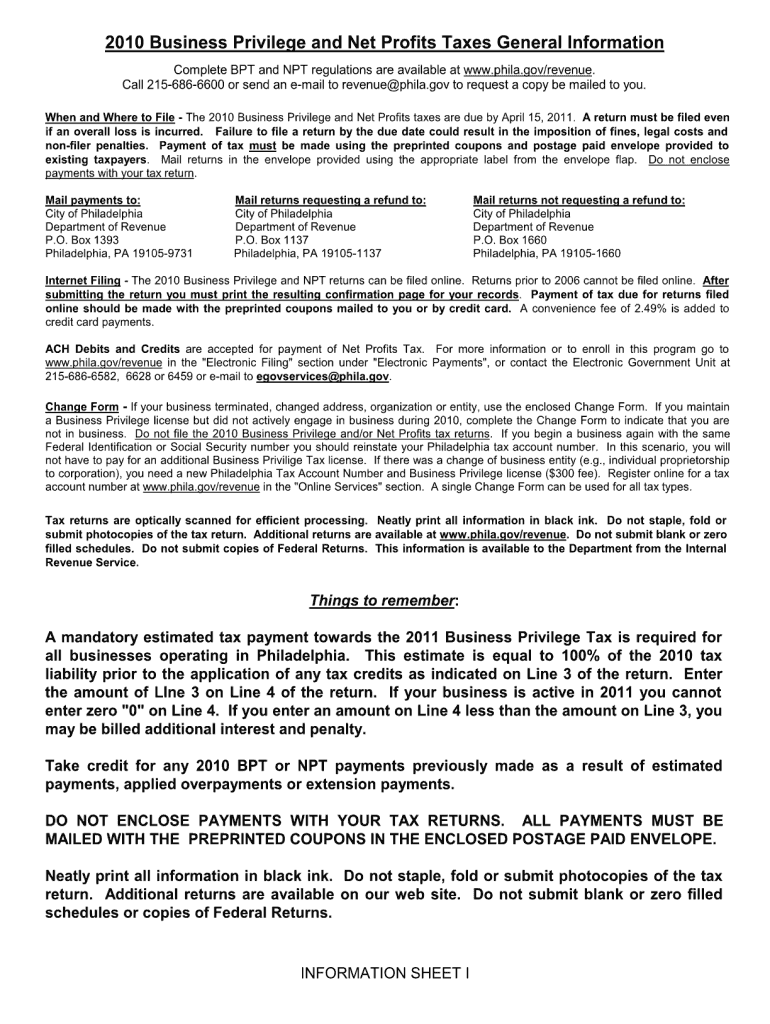

Quarterly plus an annual reconciliation. 2022 weekly Wage Tax due dates January to March PDF. 2021 tax forms.

How you can file for your city wage tax refund. 100 off Offer Details. Non-residents who work in Philadelphia must also pay the City Wage Tax.

A 245 user fee will be added to the amount due when paying by credit card. For residents and 34481 for non. Philadelphia wage tax coupon Thursday March 10 2022 Edit.

Like the Philadelphia Beverage Tax Liquor Tax can ONLY be paid and filed electronically after November 1. Wage Tax Real Estate Tax Taxes in General coupon unemployment User Name. Taxable Net Profits taxable Philadelphia Wages filing Wage and Business Tax Refund petitions etc can be emailed to the Audit Division at revenueauditphilagov.

Tax types that are listed. Please note that the following list does not cover all City taxes since some taxes must be paid through the Philadelphia Tax Center. Exact due dates for 2022 Wage Tax filings and payments.

100 Off The Income Tax School. The City Wage Tax. There are no paper returns or payment coupons for PBT.

4 hours ago Income Tax School Coupon. Forums Pennsylvania Philadelphia. 51 off 3 months ago May 13 2021 Philadelphia School Tax Payment Coupon.

Tax due on these returns or bill can be paid with a credit card or E-Check. For specific deadlines see important dates below. Business Services Automobile and Parking Wage Tax.

Youll need a letter from your employer or from payroll. Find a license or permit. If your company doesnt file en masse you can file for your own refund.

All Philadelphia residents owe the City Wage Tax regardless of where they work. For questions about City tax refunds you can contact the Department of Revenue by emailing the Tax Refund Unit or calling any of the following phone numbers. The Philadelphia City Wage Tax is a tax on earnings applied to payments that an individual receives from an employer for work or services.

Skip to Main Content. The City Wage Tax is a tax on salaries wages commissions and other compensation. Pay Outstanding Tax Balances.

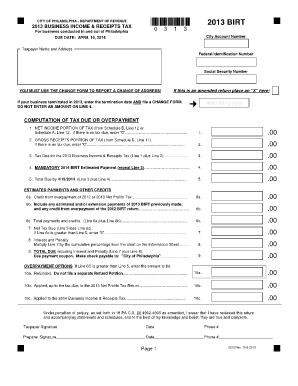

2018 Birt Extension Fill Online Printable Fillable Blank Pdffiller

Pay Points Prepare A Wage And Tax Statement Form W 2 To Be Given To Williams 1 Course Hero

Prepare The Annual Reconciliation Of Employer Wage Chegg Com

City Of Philadelphia Taxpayer Information

1 On The Financial Statements Prepared At The End Of Chegg Com

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Philadelphia Npt Form 2018 Form Ead Faveni Edu Br

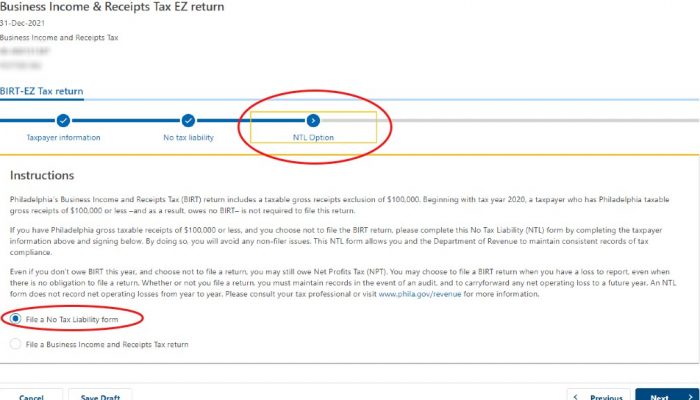

No Business Activity File Your Philly Taxes Regardless Department Of Revenue City Of Philadelphia

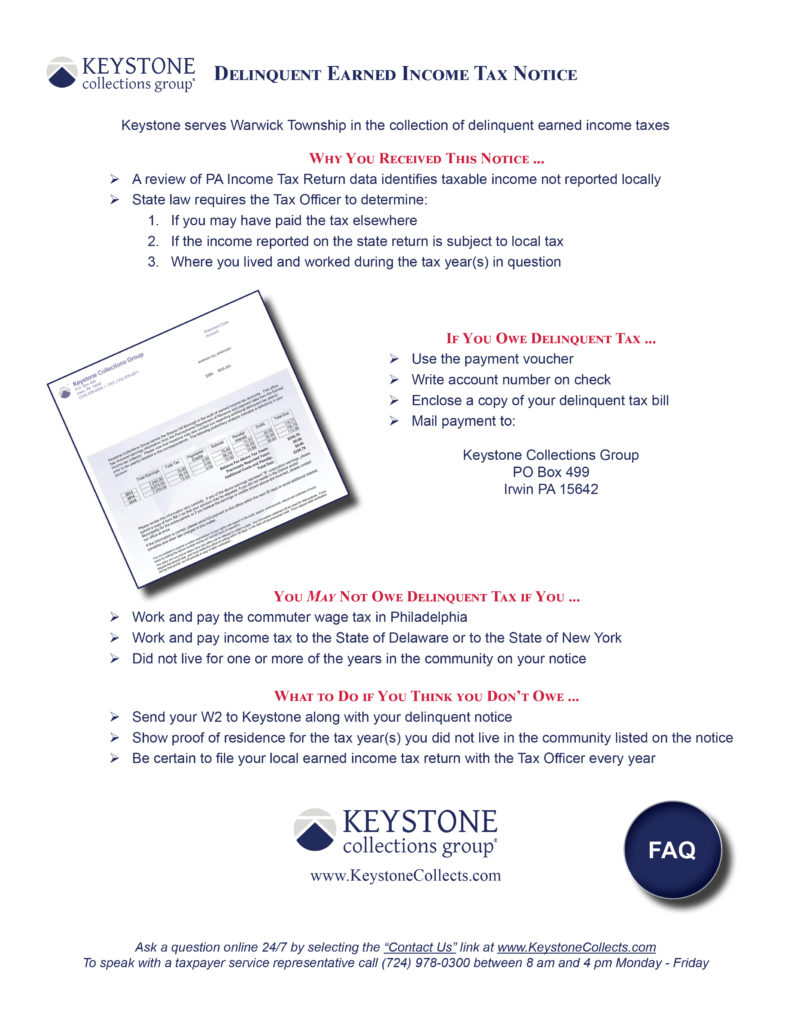

Taxes Warwick Township Bucks County

3 11 13 Employment Tax Returns Internal Revenue Service

Transaction No 44 Prepare The Annual Endilation Of Chegg Com

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors